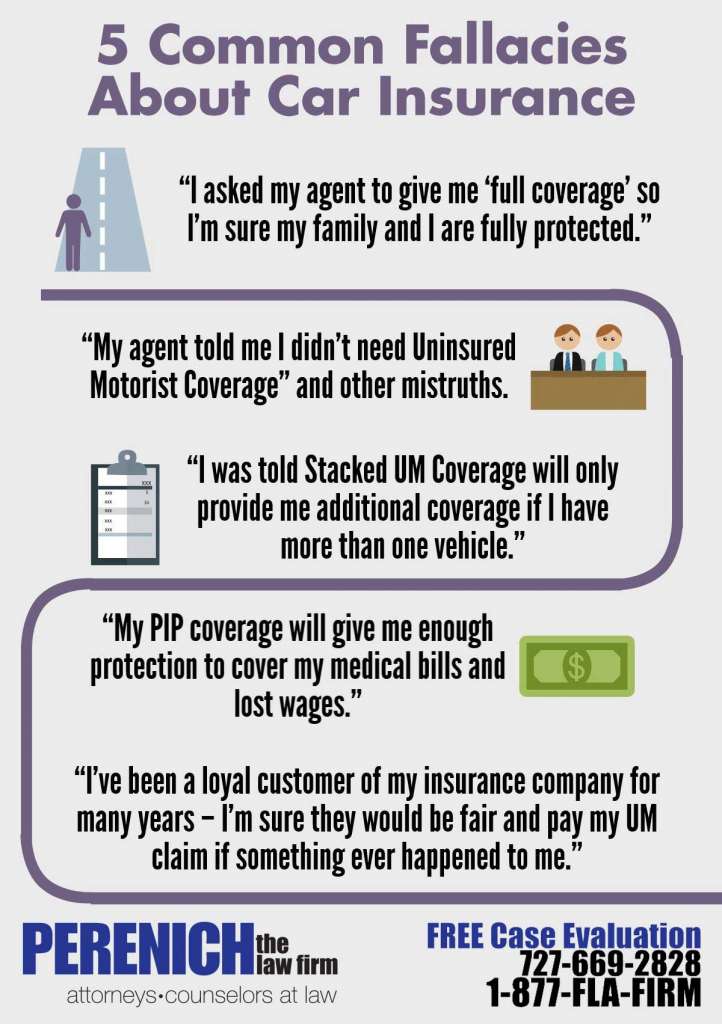

5 Common Fallacies About Car Insurance

The 5 Most Common Fallacies You Need to Know About Your Car Insurance – Before You Get in an Auto Accident!

By Florida Personal Injury Attorney Greg Perenich

- “I asked my agent to give me ‘full coverage’ so I’m sure my family and I are fully protected.”

- Florida Financial Responsibility Law does not require insurance companies to provide automobile policies with certain types of important coverages such as Bodily Injury Liability or Uninsured/Underinsured Motorist. The only mandatory coverages are Personal Injury Protection (PIP) and Property Damage Liability. PIP and Property Damage will not adequately protect you and your family in the event of an accident with injuries. There is no such thing as “full coverage” under Florida Law.

- “My agent told me I didn’t need Uninsured Motorist Coverage” and other mistruths.

- Uninsured Motorist (UM) is the most vital type of auto coverage. By some estimates nearly 25% of motorists in Florida do not have Bodily Injury Liability coverage, meaning you and your family will not be protected sufficiently in the event of another driver’s carelessness. The remaining 75% of policies that have Bodily Injury Liability coverage typically do not have sufficient coverage limits to protect you and your family. So when your agent tells you don’t need UM and asks you to sign a form rejecting it or electing non-stacked coverage, don’t do it!

- “I was told Stacked UM Coverage will only provide me additional coverage if I have more than one vehicle.”

- This is another half-truth. Stacked UM not only doubles or triples the amount of UM under your policy depending upon the number of vehicles that are insured, it also provides more expansive coverage in other instances such as if you are injured while occupying a non-owned vehicle or if a resident relative is injured by an uninsured or underinsured motorist while driving or occupying a vehicle that is not listed under your policy. Don’t take the risk of having a critical gap in coverage. ALWAYS PURCHASE STACKED UM COVERAGE.

- “My PIP coverage will give me enough protection to cover my medical bills and lost wages.”

- So sorry, sadly mistaken again. PIP or Personal Injury Protection only covers 80% of what your insurance company considers to be “reasonable, customary and causally related” to the auto accident – and 60% of your actual lost wages – up to a combined total of $10,000. PIP is primary so that means your health insurance will not kick in and cover your medical bills until the $10K in coverage is exhausted. With this in mind the best case scenario leaves you with having to pick up the remaining $2,500 in bills (80% of $12,500 = $10,000). In addition, the PIP statute was changed substantially in recent years and now excludes certain treatment modalities such as massage therapy and imposes a $2,500 limit for medical coverage unless your insurance company thinks you have an emergency medical condition.

- “I’ve been a loyal customer of my insurance company for many years – I’m sure they would be fair and pay my UM claim if something ever happened to me.”

- You and your agent may have a great relationship, but claims are not decided by agents, they are examined by the carrier’s claims office. Adjusters have only specific authority to resolve claims and are paid to save the carrier money. They are, by definition, looking for opportunities to minimize the value of the case, such as attributing your injuries to pre-existing conditions or even blaming the accident on their own insured. Moreover, they can compel the insured to be examined by a doctor of their own choosing who is frequently paid by the carrier to render opinions about causation of injuries and whether or not the insured has a permanent injury.

Each year when your auto policy is renewed, you owe it to yourself and your family to carefully examine each type of coverage you have and those types of coverages you don’t have to understand what will be covered.

If you have questions or are not sure about your coverages, call us at today 727-669-2828 to have a free consultation to fully understand your rights under Florida Law. Do it before you’re been hurt in an auto accident so you can decide on the right coverage to protect you and your family.

[efb_likebox fanpage_url=”152268688131129″ fb_appid=”1479687625619977″ box_width=”300″ box_height=”” colorscheme=”light” show_faces=”1″ show_header=”1″ show_stream=”0″ show_border=”1″ ]