Hit By An Uninsured Driver

Getting in an accident is never a good experience. Getting in an accident with another driver that does NOT have insurance can be devastating.

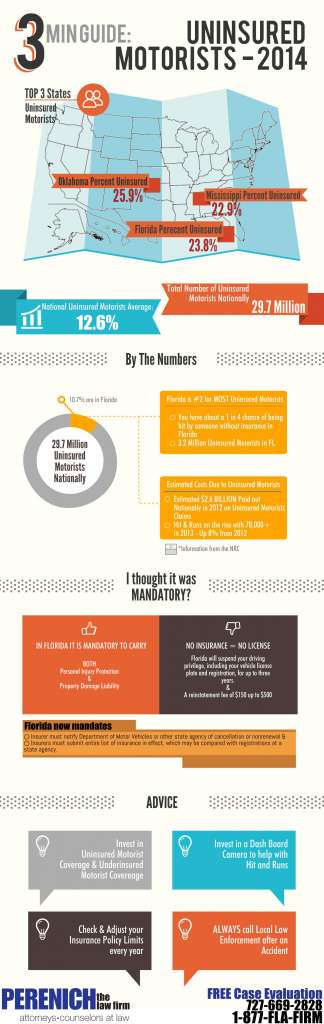

Even though in the state of Florida it is illegal NOT to have insurance on your automobile, many people still don’t. By “many” we actually mean almost 25 percent! At least that’s what the newest Insurance Information Institute report says where it states approximately 23.8 percent of all drivers in Florida are currently driving without insurance. That makes Florida the second highest percentage of uninsured motorists in the country.

Keeping that astronomical number mind, let it sink in that there were also 75,000 PLUS hit and run accidents in Florida in 2013. Too much of a coincidence? You’re not the only person to think so. As the average percentage of Uninsured Motorists goes up, so does the number of hit and runs. People without insurance that get in an accident already know they are breaking the law, why would they stop? Irresponsibility permeates an uninsured motorist’s life. They weren’t responsible enough to even pay their bills, do you really think they will be a responsible driver on US 19?

So this is a problem and our local governments are trying to curb it, but what are they doing?

Currently if you “lose” you insurance in Florida the law makes it mandatory that your insurance company report it to the state. After the state receives that report they automatically suspend your license for up to three years. You want it back? Not only do you have to prove to the state that you have insurance after a suspension you also have to pay a MINIMUM of $150 (all the way up to $500) to get your license reinstated.

Where’s the light at the end of the tunnel?

Uninsured motorist numbers are not going to start falling any time soon. With the newest laws in place they are creating a cyclical problem where people that could not afford their car insurance in the first place are now faced with an even larger financial hardship trying to reinstate it. The only real way to battle getting hit on US 19 by a car without insurance is to make sure you have Uninsured and Underinsured motorist coverage (or UM Coverage) on your current plan.

By having UM coverage you are protected even when the other driver involved in an accident isn’t. UM Coverage allows you to worry about suing the at fault driver for damages later (if they even have assets to sue for) and get your car repaired and medical bills paid for without having to worry. UM Coverage will even help you in a hit and run where the identity of the at fault driver isn’t known.

Protect yourself and your family with Uninsured Motorist Coverage. Currently there is about a 1 in 4 chance that the person that you’ll be hit by a uninsured driver.

If you or a loved one has been in an accident whether insured or not and you have any questions please give us a call right now at 727-669-2828. There is no case or question too small that it isn’t worth your peace of mind.